I wanted to post on "Americans Have Been Taken Hostage" last week but got caught up with the beginning of the school year and other posts. The article is written by Dylan Ratigan, host of MSNBC's Morning Meeting. In a few words he argues - and I agree - that America's financial interests have been hijacked and taken hostage by well-heeled and powerful interests on Wall Street.

Their power is made evident by two developments. First, virtually no one on Wall Street has had to pay for their stupidity and greed, even though their actions spiked unemployment, destroyed retirement wealth, collapsed home values, and brought us the worst recession since the Great Depression. Second, nothing has been done to change the status quo, which means it's all going to happen again. With reference to the former, Ratigan asks:

Why did we pay Goldman Sachs and all the other banks 100 cents on the dollar for their contracts with AIG, using taxpayer money, while we forced GM and others to take massive payment cuts?These are good questions that I think any member of Congress would be hard-pressed to address. To be sure, we might hear the usual "We need to do something about _________" which would be followed by "blah, blah, blah." And that that would be the end of it.

Why hasn't any of the bonus money paid to the CEOs that built this financial nuclear bomb been clawed back?

... why does the US Congress refuse to outlaw the most anti-competitive structure known to our economy, one summed up as TOO BIG TOO FAIL?

For those of us who live in the real world, where corporate donations for the next election cycle aren't our lifeblood, the proper response would be (or would have been) to allow bankruptcies in the financial market, nationalization of the failed institutions, and the settling of contracts at par value - even if it was five cents on the dollar. In my view, if the U.S. taxpayer is paying for the bailout, we should own the institutions. The idiots who got us into this mess shouldn't be allowed to continue running things, with bonuses, as if they were victims of unforeseen forces.

We also should have followed this up with retroactive taxes on the CEOs and other executives of the bankrupt financial institutions who received bonuses and other pay benefits for their "sterling" performances over the previous five years. At the end of the day these people did not create wealth. They sucked it up and then destroyed it for others. A "failed corporation" tax clawback would go a long way in sending a message about accountability and personal responsibility. Seeing a few CEOs file for bankruptcy would help middle class morale too.

Finally, why don't we break up the financial institutions like we broke up Ma Bell and John D. Rockefeller's Standard Oil? No financial institution should be so large that it can call on and confiscate the resources of the state simply because it's considered too big to fail. As I wrote in my book, when I discussed the dangers of "too big to fail":

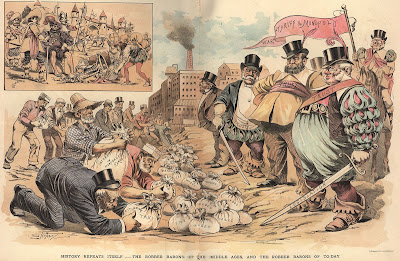

When the state allows the private sector to draw on the public treasury when market break down, it also allows the private sector to act like history's tyrants, who placed their needs above those of the public (p. 244).Much needs to be done (which is why I like this observation from Sonia Sotomayor). Think about it. Together, Bank of America, JP Morgan Chase and Wells Fargo have more than one third of all deposits in the United States. If we throw Citibank and Merrill Lynch into this group these five corporations represent almost two out of every three credit card issuers in the country.

At the end of the day, as Dylan Ratigan tells us, we can't continue calling those who built and ran the failed financial institutions capitalists. They are, as I point out in my book, financial tyrants and social parasites. The sooner Congress recognizes this, and begins regulating them as such, the better off all of us will be.

More importantly, it could also mark the beginning of the long hard slog that will be our recovery.

- Mark

No comments:

Post a Comment